Gibson's Bankruptcy: What Could Happen Now in The Case.

/Upon hearing the news of Gibson Guitar's Chapter 11 bankruptcy filing, those of us in the guitar community were shocked but not surprised. I wrote a blog article two years ago when Gibson's credit rating was downgraded and the writing was on the wall then.

As a former Bankruptcy Attorney & Music Attorney for over 21 years, I'll give a brief summary of how Chapter 11 works and what could happen at Gibson during the case.

Chapter 7 is a liquidation case, where a company is chopped up and assets sold off and the business is closed. Chapter 11 is a reorganization case, where the company tries to find a way to not only stay in business, but emerge stronger by shedding certain debts, assets and contractual commitments. Gibson filed a Chapter 11 petition, seeking to restructure.

For the moment, creditors are being cooperative with stockholders and the management backed Chapter 11 Plan. It appears that the plan is to undo the huge financial blunder of buying electronics and audio assets from Philips in 2014 and get back to what they are known for: guitars.

However, this management and creditor plan could change and a number of things could happen that nobody can really anticipate.

Creditors Can Object & A Plan Has To Eventually Be Confirmed

Chapter 11 proceedings are not always cooperative. There is a tension between what creditors individually and collectively will agree to versus forcing the company into a Chapter 7 liquidation and selling assets to satisfy creditors.

Any Creditor can propose their own Plan of Reorganization

In fact, it is a business strategy for companies to purchase some debts just to file a takeover plan of reorganization. Competing plans are a natural part of the Confirmation process in a Chapter 11 case and there are often many proposed.

Equity Groups Can Intervene

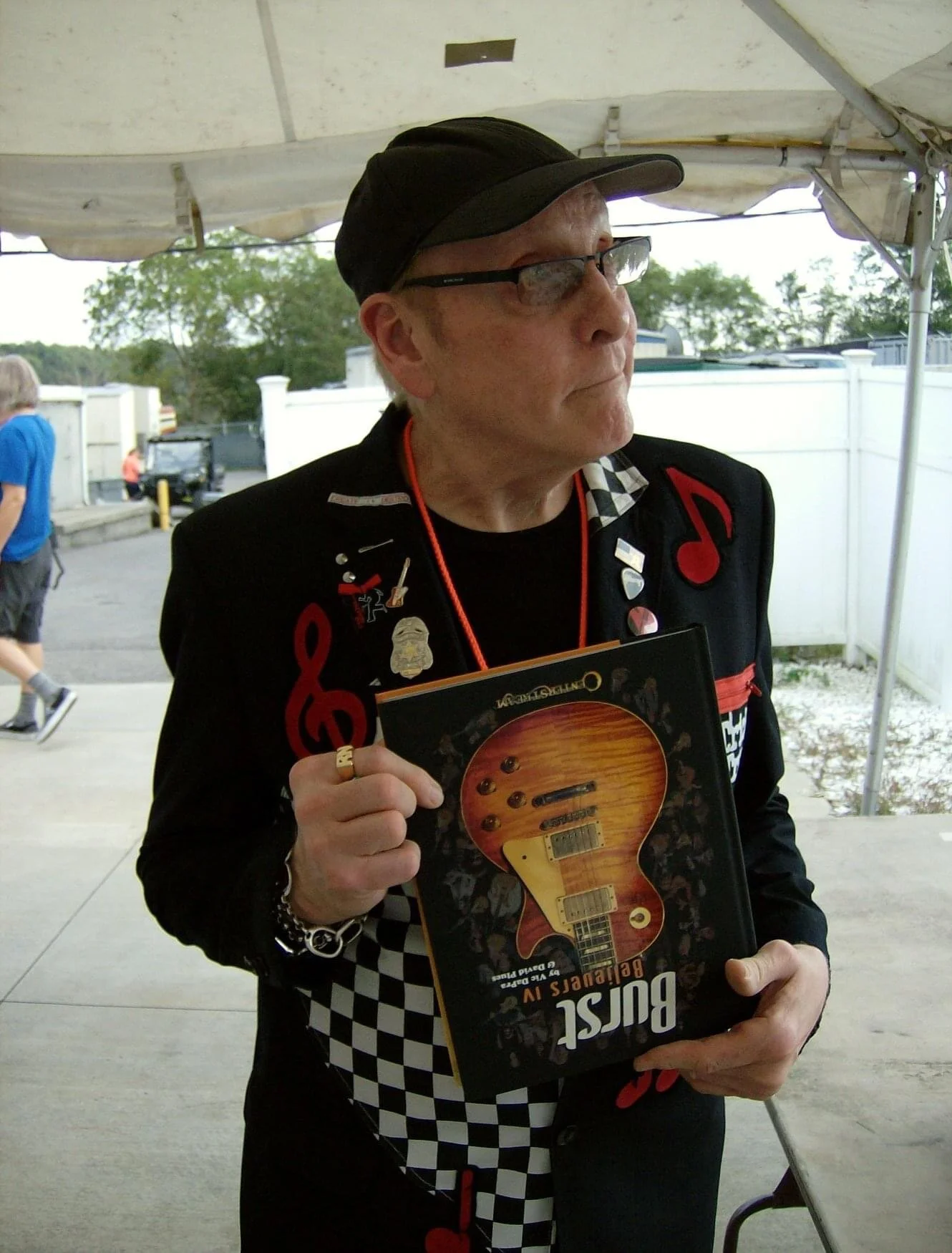

There have already been rumors that Guitarist Joe Bonamassa may be putting together investors and financing to step in to get Gibson back to it's guitar making roots. Joe, as many know, is an avid collector of all things vintage and plays rare 1950s Les Pauls on tour. He has done much to keep the Gibson Les Paul in the minds of music fans and who knows? Maybe a more guitar player based management and/or board of directors could make a huge difference in the future of the company.

How The Company Will Operate During The Case

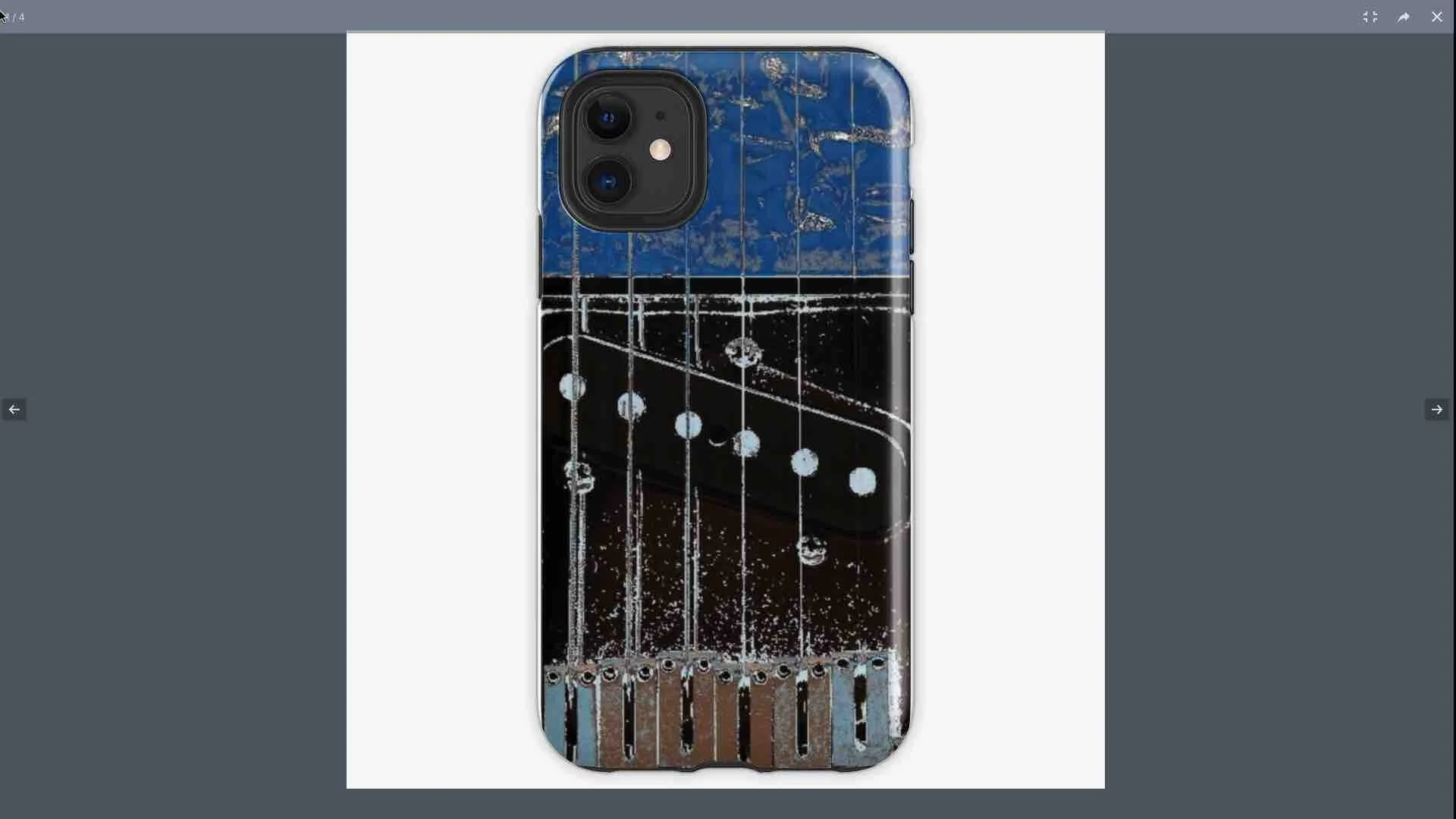

As Nigel will tell you, these go to 11!

In other types of bankruptcy cases, a Trustee is appointed to administer a bankruptcy estate. In a Chapter 11 like Gibson filed, the company will be a "Debtor-In-Possession" and current management will continue to run the company.

The Chapter 11 Plan will be proposed, discussed and eventually voted upon by creditors as will any other competing Plans. However, it's important to remember that it all comes down to who is owed the most money and the behind-the-scenes negotiations among creditors and with the company that often determine what will be the final outcome.

Will an aggressive equity or creditor based group propose a competing plan that might include ouster of current management?

Gibson CEO Henry Juszkiewicz is not well loved among the consumers of the brand and many believe that it is his poor decision making a few years ago that has led Gibson to their current situation.

Here is link to a very good Time Magazine article with specifics about Gibson's creditors and other financial details of the Chapter 11 Plan and an effort that has already been made to ouster the current CEO.

Rick Baker is a Music Business Consultant & former Music & Bankruptcy Attorney, lifelong player of Gibson Guitars & Founder of Guitar Stories USA. CONTACT HIM TO TALK ABOUT YOUR MUSIC BUSINESS.

So we shall see. I think the odds are good Gibson will emerge from Chapter 11 a stronger company. But I also think they need to take a hard look in the mirror to see how they got here and to remember to stick to what they are known for...building some of the best guitars ever made.

Stay tuned for more and feel free to contact me if you would like more information about how all this works or any other music industry issues.